Why Hire an Accountant When Starting a Business?

Entrepreneurs looking to hire an accountant for small businesses are making one of the most important decisions for their business. Accountants are essential for relevant and accurate information to base decisions on. They must be knowledgeable, communicative, and timely. Many entrepreneurs begin with a search “small business accountant near me” or “accountant for a small business near me,” but locality is much less important than the quality of service. Many of the best accountants or accounting firms operate remotely. This blog will explore the major questions entrepreneurs have regarding hiring an outsourced accounting expert.

Do I Need an Accountant for My Small Business?

All businesses need someone fulfilling the accounting function, but not necessarily an experienced accountant. Many small businesses of less than 5 people have their business owners do their accounting. This works because of the low transaction volume and the overall size of the business. Businesses with higher transaction volumes, more revenue, and more people are more likely to need an outsourced or full-time accountant.

Should I Hire an Accountant for My Small Business?

Not every small business needs an accountant to handle its financial function. However, most small companies could benefit from greater financial clarity or more time on their hands. Each small business is uniquely positioned to have either an outsourced accounting function or an in-house accountant. We’ve created 5 signs to help indicate when you need either a full-time or outsourced accounting resource.

5 Signs Your Small Business Needs an Outsourced Accountant

In the hustle and bustle of running a small business, it’s easy to get caught up in daily operations and overlook certain aspects that could be crucial for growth. One such area is accounting. Here are five clear signs that it might be time to consider outsourcing your accounting tasks to an expert:

You Are Not Proactively Making Decisions Based on Your Financials

It’s not just about having a record of your finances; it’s about using them to inform and guide your business strategy. If your business decisions are more reactive than proactive, or if you need to regularly consult your financial reports before making significant decisions, it might be a sign that you need an accountant to provide clarity and insights from your financial data.

Your Revenue is Growing, but Your Profits are Not

If you’re noticing a consistent increase in revenue but stagnation or decline in profit, there may be underlying issues that you need to include. An outsourced accountant can help scrutinize your income and expenses, pinpointing inefficiency, excess costs, or opportunities for better financial management.

You’re Spending More Than 8 Hours a Month on Accounting

Time is money. Suppose you’re dedicating a significant amount of time to managing your books instead of growing your business, strategizing, or focusing on core operations. In that case, you’re not focusing on what’s most important. An outsourced accountant can streamline and manage these processes, freeing up your time to focus on what you do best.

You Need Financial Forecasting

As your business grows, it becomes crucial to clearly understand where you’re headed financially. This includes predicting future costs, revenues, and potential challenges. An accountant can provide these insights, helping you to budget, plan for future growth, and anticipate potential financial obstacles.

You Want Expertise in Your Financial Function

The financial realm is vast, and it’s challenging for one person to be an expert in all aspects. Whether it’s tax codes, industry-specific regulations, or leveraging financial tools and software, an outsourced accountant brings expertise. They can ensure you’re compliant and taking advantage of any economic benefits or opportunities available to your business.

5 Signs Your Business Needs a Full-Time Accountant

- Your transaction volume is between 500-750 or more each month

- Your current accounting structure is overloaded or too expensive

- Your business is growing rapidly

- You have a lot of outstanding invoices

- You are ready to build out a finance team

Is It Important to Have an Accountant for a Small Business?

Yes, it is important to have an employee fill the accountant role. This could be a full-time accountant or someone who is trained in accounting doing it as one of their functions. It all depends on how laborious the accountant’s role is. A professional accountant can help with:

- Monitoring a company’s financial records and financial reports

- Managing accounting software

- Preparing financial statements

- Understanding tax obligations and tax laws

- Assisting with business growth and updating the business plan

Why Is an Accountant Important to a Small Business?

The reason an accountant is important to small businesses is because they help show the past, present, and future financial state of your business.

Past

Accountants are in charge of recording and correcting historical financial data. This practice helps businesses understand their growth, costs, best and worst products, and more. Historical data is often the driving force behind future decision-making and forecasts.

Present

The value of accurate and timely financial practices is the ability to understand the current state of the business. Accountants’ work results in understanding cash, revenue, expenses, inventory, and more in real time. This information leads to better decision-making.

Future

Higher-level accounting allows you to make educated forecasts of the future financial state of your company. For example, a financial forecast can indicate the cash flow impact of hiring one vs. two new employees. Financial models can also predict revenue and expense growth.

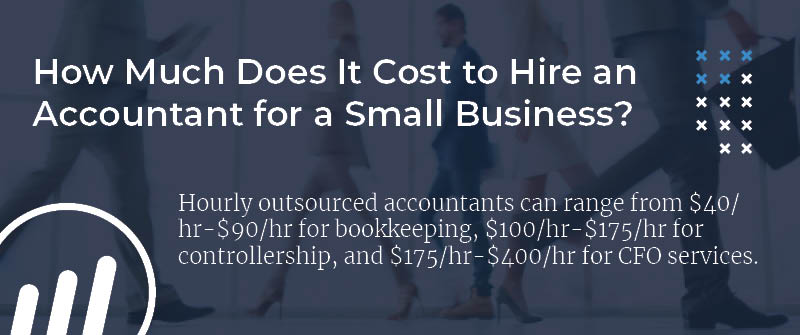

How Much Does It Cost to Hire an Accountant for a Small Business?

If reading this blog made you realize “I need an accountant for my small business,” then it’s important to know the costs. Indeed reports the average salary of an accountant is $61,871. This does not include benefits. Outsourced accountants do not get paid benefits. They are paid on an hourly or fixed monthly fee basis. Hourly outsourced accountants can range from $40/hr-$90/hr for bookkeeping, $100/hr-$175/hr for controllership, and $175/hr-$400/hr for CFO services. Fixed fees are usually a combination of controllership and remote bookkeeping services, with an average package of around $1,250/month, but these can vastly vary depending on the level of service.

How Milestone Can Help Small Business Owners Improve Cash Flow and Accounting

Milestone’s fractional accounting services are built to help small businesses fulfill their accounting needs. We offer bookkeeping, controllership, and CFO-level accounting services to small businesses at a fractional price tag. We work with hundreds of small businesses, so we bring our experience into our processes to help optimize your business’s financial function. Reach out today to learn more about how we can help your small business.

Related Content

Milestone Cites Record Growth in 1H 2024, Adds New CFO Practice Leader

Tech industry veteran to bring depth of start-up/scale-up experience and help expand geographic reach INDIANAPOLIS, IN (July 16, 2024) Milestone Business ...

What Are The Three Types Of Accounting Services For a Small Business?

Small businesses often outsource some or all of their accounting function to gain access to expertise at a fractional cost. ...

Why Outsource Your Monthly Bookkeeping Services

The fractional economy is here. Small businesses are realizing the benefits of time and money to outsource the areas they ...

Stay in the know