Fractional CFO Services

The experienced leadership you need for your growing business.

With over 25 years of CFO experience, we’ve seen it all. Whether you are looking for a strategic partner to support your growing business, a trusted advisor, or an experienced leader to guide you to a successful exit, Milestone can help.

Ready to turn your accounting into

a competitive advantage?

Our Clients

Proud to partner with high growth businesses and nonprofits.

Our accounting expertise, customized to fit your business needs.

We Utilize Best-in-Class Technology

Get Started!

Transform your accounting into a competitive advantage.

Outsourced CFO Services

Small businesses are the lifeblood of America, and many people dream of being their own boss and successfully running their own company. Plenty of those same people take the leap and follow that dream, with a staggering 99.9% of all the businesses in the US falling under the “small business” category.

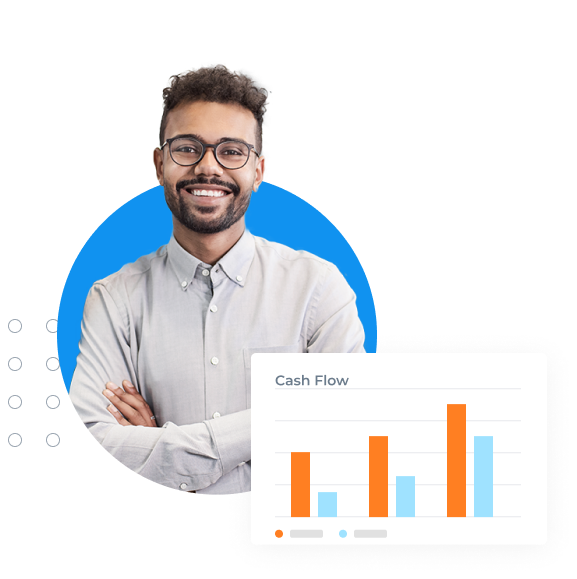

While seeing people follow their passion is inspiring, the sad reality of what happens with those small businesses is reflected in a study by U.S. Bank. This study showed that 82% of small businesses fail because of cash flow mismanagement. Despite their many skills and talents, business owners often lack the financial knowledge to keep their company on sound financial footing, and hiring a full time CFO is not usually an option.

Discouraged? Don’t be! We’ll examine a solution to this problem and explore the “outsourced CFO services” meaning. Let’s dive in and discover how you can avoid the common mistakes that lead to small businesses failing and how to best set yourself and your company up for future financial success.

What are outsourced CFO services?

Outsourcing is very popular with small and mid-sized businesses because it allows business owners to get the expertise they need at a fraction of the cost of a full-time person. When you outsource the CFO function, you get a financial expert who will provide high-level strategic advice and guidance with things like financial forecasting, cash flow planning, and debt and equity financing. A seasoned CFO will also be able to help you navigate through difficult economic circumstances. An outsourced CFO is also sometimes referred to as a “fractional CFO” due to the part-time nature of the service provided.

Virtual CFO services have become popular as a way to reduce overhead and give business owners the ability to access experts that are not in their immediate vicinity—“virtual CFO services” meaning any person or business that offers CFO functions remotely through video or phone meetings without needing to be on the premises. Worried that a virtual CFO may not give the same experience as an in-person CFO? With advances in technology and the increasing popularity of remote workplaces since the 2020 pandemic, the traditional rules of engagement have changed. Virtual CFOs can work very effectively from anywhere.

What do CFO services include?

There are many ways an experienced CFO can add value for a business. The services they provide are often a function of the life cycle stage of the business, the economic climate, and other unique circumstances. At Milestone, we can customize our services to meet the specific needs of your business at any point in time.

Our CFO services include:

Financing Expertise

Finding start-up or growth capital for your business can seem overwhelming. It requires experience and an understanding of the landscape of potential partners and available options. Whether you need to increase your line of credit, finance an acquisition or raise capital for your growing business, the financing specialists at Milestone can help you achieve your goals.

Financial Projections

Forecasting can be a difficult and time consuming task for any business owner, especially if you have never done it before. Our team of experienced CFOs will help you get a financial roadmap for your business and gain the visibility you need to make smart decisions, improve profitability, and plan for growth capital.

Cash Management

The first step in our comprehensive cash management process is to review your current practices. Using this information, we will provide clear recommendations and custom tools to help you monitor your cash flow and adapt to any situation that may arise.

Merger & Acquisition (M&A) Advisory

Mergers and acquisitions can be an exciting time for a business, and also can be stressful and full of challenges. Searching for financial advice to help you grow through an acquisition? Attempting to position your business to be sold? Whatever your circumstances, Milestone can help guide you through the process.

Succession Planning

Every strong business needs a solid succession plan in order to ensure that it will thrive for years to come. Unfortunately, this can sometimes be an afterthought and left for the last minute. Even if your target date is just around the corner, we can help you plan, prepare, and execute a smart exit strategy that will help ensure the continued success of your business. Got plenty of time to prepare? We can assist you with a succession plan that will not only help you get you prepared when the timing is right, but we will also help you do the things you need to do to maximize the valuation of your company.

Financial Turnaround

The 2020 pandemic has left many businesses struggling to adapt in a changing market and an unpredictable world. Despite the unknowns, we can assist you in stabilizing operations, improving your cash flow, and exploring options for a successful business turnaround.

How much does an outsourced CFO cost?

CFO consulting hourly rates often vary depending on the provider. While it’s difficult to estimate an average fractional cfo hourly rate, it is reasonable to assume that it will be somewhere between $250 and $400 per hour, depending on the market. Likewise, the average monthly Outsourced cfo services cost can range between $1,000 to $12,000 per month, depending on the functions you are looking to outsource and the time involved.

Most outsourcing CFO services work on a custom basis to provide a quote that matches your specific requirements and needs. The cost of outsourcing should be compared to that of hiring a full-time CFO, keeping in mind that a c-level executive will most likely want a matching salary with benefits and perks that go along with it. According to Salary.com, the current average in the US for a CFO’s salary is $394,189 per year, and the range usually falls between $300,061 and $501,028.

One of the classic mistakes we see small business owners make is that they immediately jump to the conclusion that they need to hire a full time CFO when they experience the need for a financial expert. While the need is real, there is often a simpler, more cost-effective solution in outsourcing. The right outsourced CFO will provide the leadership and experience you need and become a trusted member of your team, all at a fraction of the cost. Outsourcing is a great way to meet the needs of your business without overpaying. Many small and mid-sized businesses have utilized the services of an Outsourced CFO and completely eliminated the need to ever hire a full time person.

What are the advantages and disadvantages of outsourced CFO services?

Outsourcing your CFO services is a big decision, and it’s important to consider all the factors to determine if this is right for you and your company. While there are many advantages to outsourcing, there are some potential disadvantages that you need to consider as well.

Advantages of outsourcing CFO functions

- Ability to pay for only what you need: Outsourcing your CFO functions allows you to customize the level of support that you need in your business, and you won’t have to pay for services that you won’t use. Instead of footing the bill for an executive, you can hire someone for the specific tasks that you need completed. Need 10 hours of CFO advice? Looking for help with positioning your business to sell? With outsourcing, you’re in charge of the scope of work.

- CFOs help CEOs shine: If your business does not have a dedicated CFO, you will be amazed at how much a CFO can lighten the burden of your CEO by taking on the financial tasks. But that’s not the only way a CFO provides support. By providing insights and a fresh perspective to the CEO, the CFO helps them make sound financial decisions that will put your company on the pathway to success.

- Outsourcing grows (and shrinks) easily: Scaling can get messy, especially when businesses are in periods of rapid growth. Outsourced CFO services are highly scalable and can easily grow (or shrink) to suit your needs.

Potential disadvantages of outsourcing CFO functions

- Can you trust an outsourcing company? The answer is yes, but do your homework and find the right partner. Trusting your sensitive financial information to an outsider can be scary. For this reason, some CEOs may be hesitant to outsource CFO functions. When you engage an outsourced CFO, you have to give them the full picture and trust in your partnership. This is not a decision you should take lightly. At Milestone, we take this responsibility very seriously. One of our four core values is integrity, and we approach each client with honesty, transparency, and a firm code of ethics. When considering outsourcing, you should make sure that the company you work for is trustworthy and reliable before turning over your sensitive data.

- Are there hidden costs that will pop up? A major incentive for outsourcing CFO functions is to save on overhead costs, but fees can add up quickly. The truth is that each outsourcing provider is different, and so you want to look for a transparent and up-front company that has gained the trust and confidence of its clients. The best way to avoid surprise invoices is to set expectations up front and have a clear understanding on the scope of work to be performed.

Do outsourced CFO services for small businesses work well?

Absolutely! As we’ve discussed, there are many advantages of outsourcing CFO services. In fact, it is the preferred path for most small and mid-sized businesses because it provides the expertise they need at an affordable price point. Most entrepreneurs need the assistance of an experienced financial leader as they build their business, and outsourcing just makes sense.

For example, did you know that 29% of startups fail because they run out of cash? While having an experienced CFO by your side doesn’t provide a guarantee, a good CFO will help with things like cash flow forecasting and scenario analysis that can definitely increase your odds of success.

Of course, cash flow planning isn’t the only thing an experienced CFO can provide. A good CFO will also help you prepare a financial forecast that will be an invaluable tool to support day-to-day decision making. One staggering statistic shows that 66% of small businesses face financial challenges, and 43% say that paying operating expenses is the biggest financial challenge they have. The best way for entrepreneurs to combat these challenges is by preparing a financial forecast and running different scenarios to understand a range of potential cash flow outcomes. While there is no crystal ball, having a well designed financial forecast will allow you to use the best available information to make smarter business decisions.

Let’s examine why outsourcing CFO functions can help ease these pain points and guide small businesses on the path towards success.

Why would a business outsource CFO functions?

Remember those financial challenges? A few of the major reasons for outsourcing CFO functions are to:

Reduce overhead

Outsourcing CFO functions can save money by reducing the overhead of bringing on board an in-house CFO. Growing businesses usually reach a point where CFO services are needed, but the costs of attracting a full-time high-level executive are prohibitive. Too often, businesses choose between doing without a CFO and not addressing the critical functions that could help grow their business, and stretching to pay a high salary and benefits for a C-suite executive. The option of hiring an Outsourced CFO is a cost-effective third option that can keep your overhead in line without sacrificing the expertise that your business really needs.

You might be surprised to find that a good outsourced CFO can often pay for themselves by analyzing your current financial situation and finding improvements that can be made. For example, a good CFO might review your spending and identify ways to cut costs, or they may help in negotiating better vendor contracts. They are also skilled strategic thinkers that can help you review your pricing model and uncover opportunities to increase revenue. The bottom line is that you should think of your CFO as more than just an additional expense, they can have a positive impact on your bottom line.

Rapid growth or decline

Businesses going through a rapid growth period may reach a point where they could benefit from a CFO to help develop a thoughtful strategy for scaling the business without expending their resources too quickly. Some small businesses may not have a CFO, with the owner covering all of the executive functions, and they may or may not have the financial expertise needed to navigate the growth period successfully. Outsourcing CFO functions can give business owners the expertise they need to grow their business responsibly.

On the flip side of things, a struggling business might also benefit from financial guidance. Business turnaround strategies can be difficult to formulate if the owner is worried and stressed about the difficult circumstances they are facing. A CFO can help stabilize the operations and give fresh insight and ideas for righting the ship.

Access to expertise

Everybody likes to think that they are unique and special—which is true—but an outsourced CFO has years of experience with a multitude of financial situations. No matter what your business is going through, an outsourced CFO has probably seen and dealt with a similar situation. This expertise can be invaluable and provide the comfort of knowing that you aren’t treading in uncharted waters alone. Milestone can help you build a financial roadmap and provide the expertise to guide you through successfully.

Spreadsheets, financial statements, forecasts, dashboards…it can all seem overwhelming as a business owner. One of the best reasons to have an outsourced CFO is that they can help you make sense of it all. With years of experience behind them, they will provide a fresh perspective and offer insights that can make all the difference. You can get the information and insights you need to make timely decisions and focus your time on running the business.

An outsourced CFO doesn’t have to replace an existing CFO or financial team. Many outsourced CFOs consult on specific initiatives like raising capital, acquiring a business, or preparing a financial forecast. They can work alongside your existing team to provide subject matter expertise or an extra set of hands when needed.

Employee turnover

Whether you have a sudden departure of a CFO or are trying to determine if you need a full-time CFO position for the first time, outsourcing CFO functions temporarily can help bridge the gap and give you time to find the right fit for your team. Your financial strategy doesn’t have to suffer due to an unexpected turn of events, especially with customizable options available to fit your specific needs.

Don’t want to be left in the lurch again? Milestone can help you put a strong succession plan in place to help prevent these gaps from occurring.

What should you look for in an outsourced CFO?

Working with a fractional CFO creates a very close business relationship due to the sensitive nature of the information they are going to handle and the role they will fill as a trusted advisor to the business. When considering outsourcing services, you want to look at the following qualities in the person you will be working with:

Leadership Style

CFOs are high level executives who have to be able to lead others and help your company move forward. Asking about leadership styles and understanding what sort of leader they are will help you know if this person is going to help you get on the right track as a team

Communication Ability

When it comes to the finance function of a business, there are a lot of moving parts, and a lot of time sensitive decisions that need to be made and communicated to all parties involved. A prompt, clear communicator—both in written and verbal communications—is vitally important for your CFO.

Wide Range of Knowledge

Obviously you want to look for a CFO service that has the financial expertise that will help your business succeed, but a service that provides other functions like outsourced accounting and outsourced human resources can bring a big picture mindset to the table and help make connections between different departments of your business.

Reliable and Trustworthy

You have to be able to count on your CFO in a multitude of ways – from meeting deadlines to picking up the phone when you call. Outsourcing your CFO services works beautifully when you have a dedicated and reliable partner to lean on, but can fall apart if you can’t count on them.

Problem Solving

Be sure to consider if the outsourced CFO you are working with is a good problem solver with practical and creative solutions to your financial quagmires. Critical thinking and the ability to understand and detangle complicated situations is important for a good CFO.

Personality and Culture Fit

A few simple questions you can ask to make sure the fractional CFO you’re considering is right for you: do you like them? Do you enjoy talking with them and feel comfortable with their personality? Can you see this person interacting with your team in a positive way? Working with someone who isn’t the right fit for your company culture can create huge clashes and cause unintended consequences.

The experienced leadership you need for your growing business.

With over 25 years of CFO experience, we’ve seen it all. Whether you are looking for a strategic partner to support your growing business, a trusted advisor, or an experienced leader to guide you to a successful exit, Milestone can help. Our core values are the foundation of our firm and are our guiding principles in building relationships and helping our clients become successful. We call them our Core 4.

- Service: We are committed to do what’s best for our clients, for each other, for our business, and for our community. With each client and project, we demonstrate this commitment by going the extra mile in everything we do, providing value that exceeds expectation, and helping one another realize our goals and potential. We also understand the importance of serving our community and strive to leave the world a little better than we found it.

- Leadership: We have a deep respect and admiration for entrepreneurs. After all, we’re entrepreneurs ourselves. So, like the business leaders we work with, we are innovative, forward-thinking, and dedicated to creative problem-solving. We are leading the way in vetting new technology and providing expert guidance to our clients, all while creating a framework that allows us to grow and develop new leaders from within.

- Integrity: Who we are is just as important as what we achieve. We approach each client and every situation with honesty, integrity, and a firm code of ethics. We “practice what we preach” and apply this same code of ethics to our interactions with each other.

- Lifestyle: We are passionate about our clients and the value we create for them, but that’s not the whole story. We also value and respect our own personal goals for growth and development. We believe the more well-rounded, engaged and, well, “balanced” we are, the better we’re able to help our clients and each other.

When it comes to selecting the right financial advisor for your growing business, experience matters. At Milestone, we have a comprehensive list of CFO services and a proven track record of client success, but don’t just take our word for it! Mike Reynolds, Founder and CEO of Innovatemap, says “I’m so appreciative that I can lean on Milestone for strategic financial advice as Innovatemap continues to grow. Having an experienced CFO by my side to be a sounding board and provide a fresh perspective is invaluable.”

Milestone is not your typical professional services firm. We believe in true business partnerships and approach every client interaction with this goal in mind: to make your life easier, provide you access to information to make smarter decisions, and to help you build a more successful company.

Our team is your team, and our model is simple: You get experienced C-Level leadership at a fraction of the cost of a full-time resource. We promise no long term contracts, no hassles, and the flexibility to scale up or down as your business needs change. Because every business deserves access to strategy and expertise, no matter their size.

Click here to learn more about the Milestone difference and unleash your back office.